Return to journal

How thematic investors can help you shape your D&I reporting

Regulators often use the annual report as a policy tool to change behaviours by shining a light on a particular issue. A multitude of reporting frameworks outline voluntary disclosures for a sustainability report while ESG indices have their own requirements. As these have evolved, many companies have found themselves with a hotchpotch of disclosures in various places.

In the case of diversity and inclusion (D&I), understanding what thematic investors are looking for can help cut through the confusion to shape your D&I strategy and communicate it internally and externally. For companies that are serious about D&I, a dedicated report forms an essential part of the communication mix. We show how this should be used alongside your annual report and website to communicate a compelling story.

Using the annual report as a policy tool has its merits – it has the highest profile of any corporate document and is reviewed by the entire Board. You can be sure that any disclosure in this publication will have had the full attention of the most senior decision-makers.

However, reporting legislation is a blunt tool to drive change. Modifications to the Companies Act in 2013, stipulated that companies should provide the number of people of each sex who were directors, senior managers, and employees in their strategic report. While the definition of a senior manager posed a challenge, reporters know what’s expected of them when asked to provide quantitative information. When it comes to providing qualitative information, the legislation and guidance are less explicit – and less useful.

Reporters should provide “information on policies in relation to employee matters and progress against them”. Reporting disclosures are qualified with language such as “the extent necessary for an understanding of the development, performance or position of the company’s business”. There’s a lot of wriggle room and it’s not the sort of language that will promote a compelling message on gender diversity. The high profile of an annual report can also work against it. It’s easy to understand how a reporter with good intentions can see their initial draft pared back by internal stakeholders and advisors whose objective is to minimise risk and avoid drawing attention to areas where their story isn’t as strong, which often includes diversity. There are also legal and practical challenges to address. For example, companies with smaller headcounts are sensitive about collecting data that can identify individual members of staff.

The reporting rules on Board diversity, albeit on a comply or explain basis, are a little more explicit thanks to the Governance Code and the Financial Conduct Authority’s (FCA’s) Disclosure Guidance and Transparency Rules. For example, the annual report should include the policy on diversity and inclusion, its objectives and linkage to company strategy, how it has been implemented and progress on achieving the objectives as well as the gender balance of those in the senior management and their direct reports.

Regulation therefore exists but is imperfect and focused mainly on gender diversity. Meanwhile, the world has moved on. There is a better appreciation of the relationship between D&I and healthy working cultures and innovation. Studies show It reduces risk and supports good conduct. Moreover, society is more aware of inequality and eager to make a stand.

Thematic investing, which predicts long-term trends that can change an entire industry is not new. It has been embraced by fund managers that see it as a way of addressing ESG issues by investing in specific solutions. For example, funds that address climate change are likely to include companies innovating in renewable energy. Importantly, it shows how investment can allocate funds to areas that can make a real difference to the challenges facing society.

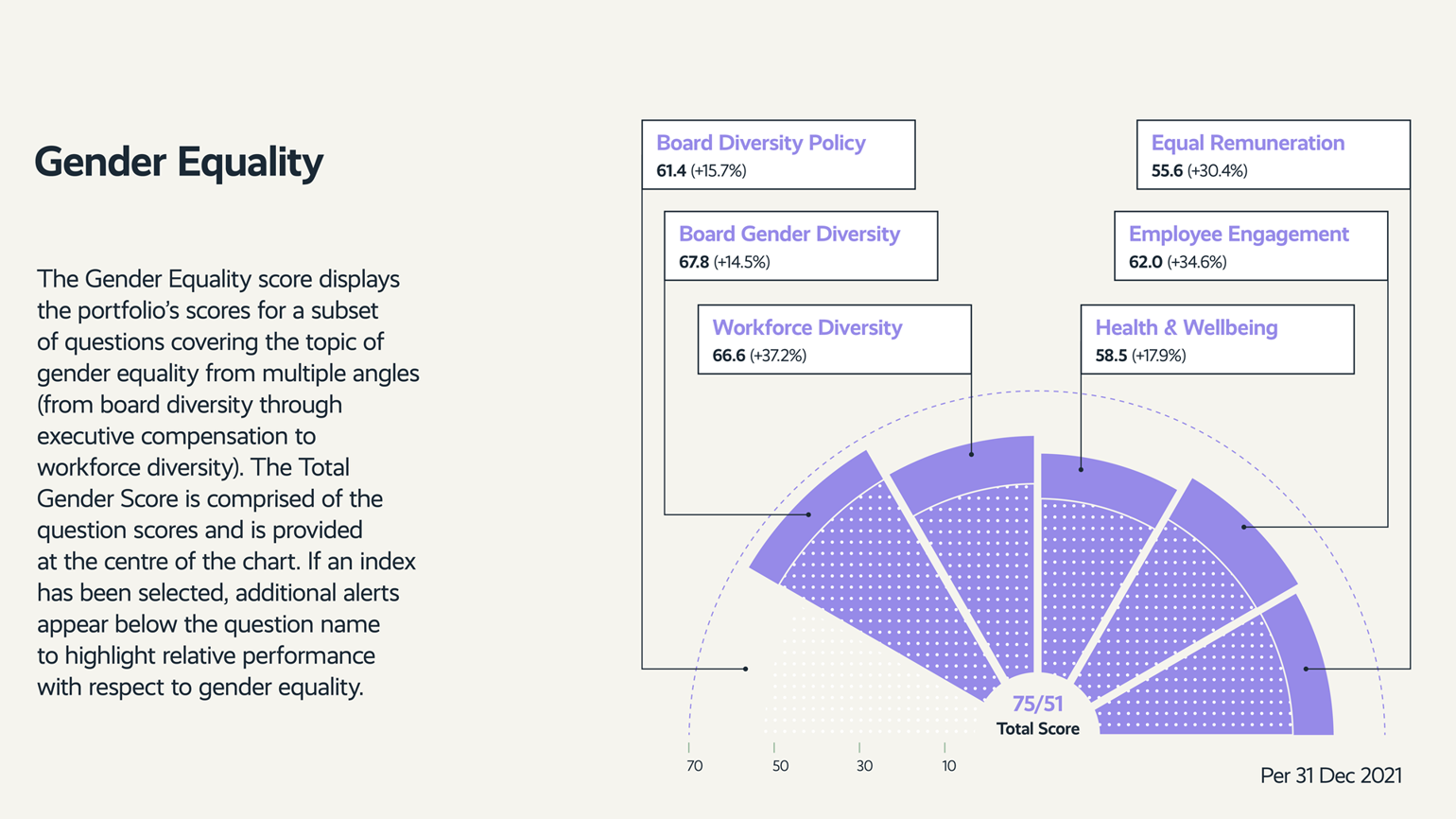

Since 2015, you can invest in a fund from Robeco that selects companies from around the world that advance gender equality. Sustainability considerations are incorporated into the investment process to identify risks and opportunities and negative screening excludes the 20% worst ESG scoring stocks. Crucially, the fund invests at least two thirds in companies that have a gender score of 50 or higher based on its methodology:

As well as making investment decisions, the likes of Robeco will engage with a company’s Board and often request they produce a D&I report to help raise standards. Measures such as the UK Stewardship Code have raised the bar on stewardship to encourage engagement and address tricky long-term issues.

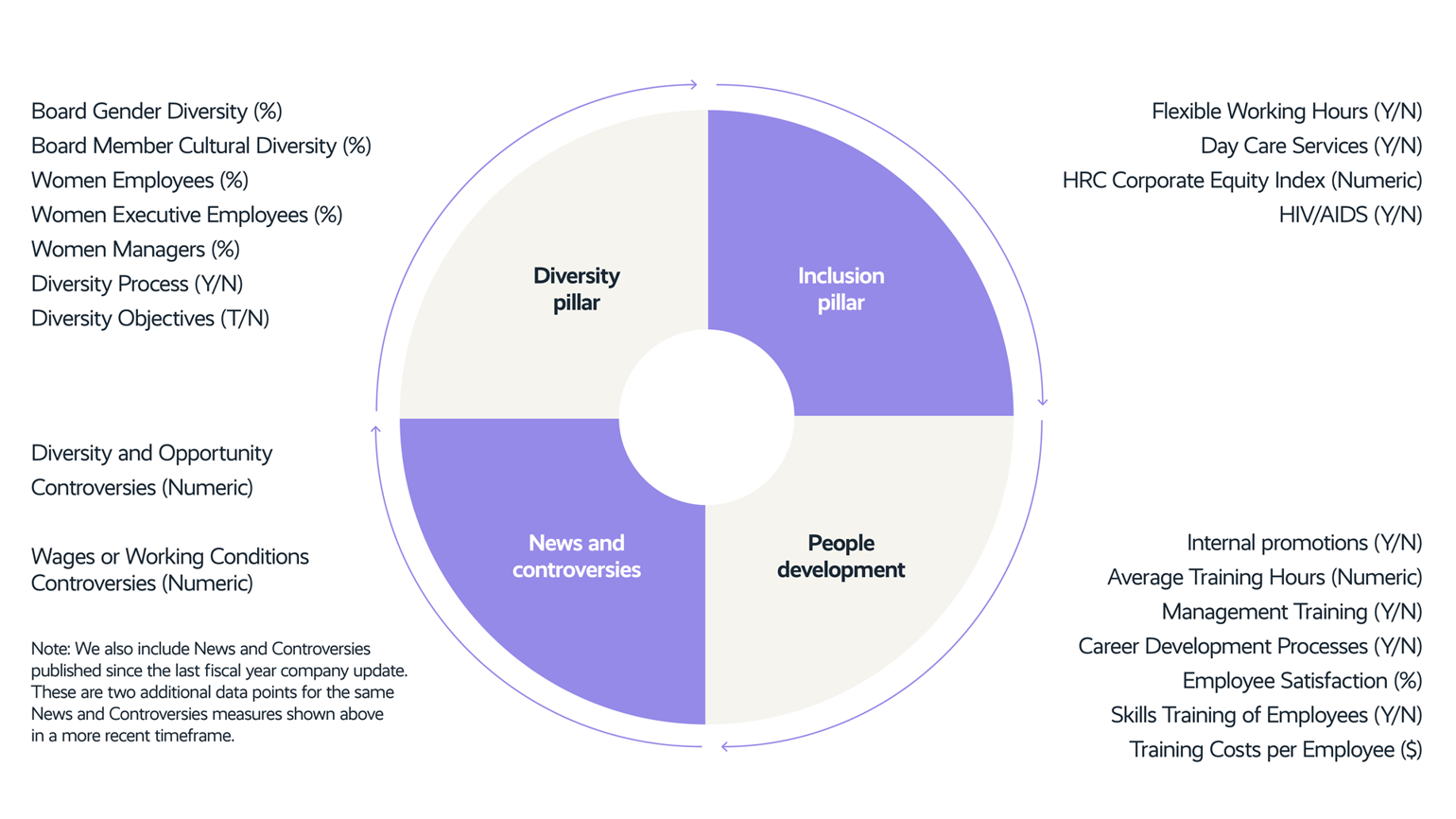

One step removed from fund managers is data providers that supply ESG related information they can integrate into the investment process. One provider is Refinitiv, which is owned by the London Stock Exchange. Its Diversity and Inclusion (D&I) ratings provide one of the most comprehensive insights into the information that is being used to form opinions on investment prospects. It takes 24 measures and allocates them to one of four pillars:

Information that shapes investment decisions provides a basis for reporting on D&I. We recommend a three-pronged approach to communicate a compelling story based on information used by thematic investors:

The annual report is the first port of call for a new investor and is used increasingly by other stakeholders such as employees. We believe companies should go beyond the minimum requirements on gender diversity to provide a fuller and more rounded picture. It should present a compelling case for D&I, a strategy to achieve its objectives and an honest appraisal of progress towards its goals.

The website should support the annual report, holding additional context and additional data. A key consideration is the user’s experience as this is where experts can find all the information they need in one place. This includes supporting documents such as policies that don’t change much from year to year and would take up too much space in an annual report. It’s also a bridge to social media channels where companies can amplify their message on D&I and direct stakeholders to the website for the full story.

A dedicated D&I report is the clearest signal that a company is committed to D&I. The value of reporting as a management tool is often underestimated but the work involved in writing a report is hugely helpful for gathering information internally and developing a D&I strategy. Consulting widely within the business at all levels helps a company establish its position and gives it the confidence to be bolder with its external reporting.

At a time when businesses need to position themselves as employers of choice and rise to the challenges set by wider society, D&I reporting has never been more important.