Return to journal

Best practice for better business models

How to bring innovation to your business model reporting, written by strategy director Sean Bride

When it’s done well, best practice raises standards in reporting by sharing innovative ideas, as seen in risk reporting. But in other areas it has stifled innovation and lowered standards. One of those areas is business model reporting, where too many distil complex businesses into overly simple representations comprising inputs, activities, and outcomes.

There’s a better approach. Our framework for developing business models revisits the guidance to raise standards. It is a pivotal disclosure, which investors consider to be fundamental to their understanding of a company, its performance, positioning and prospects.

Choosing content

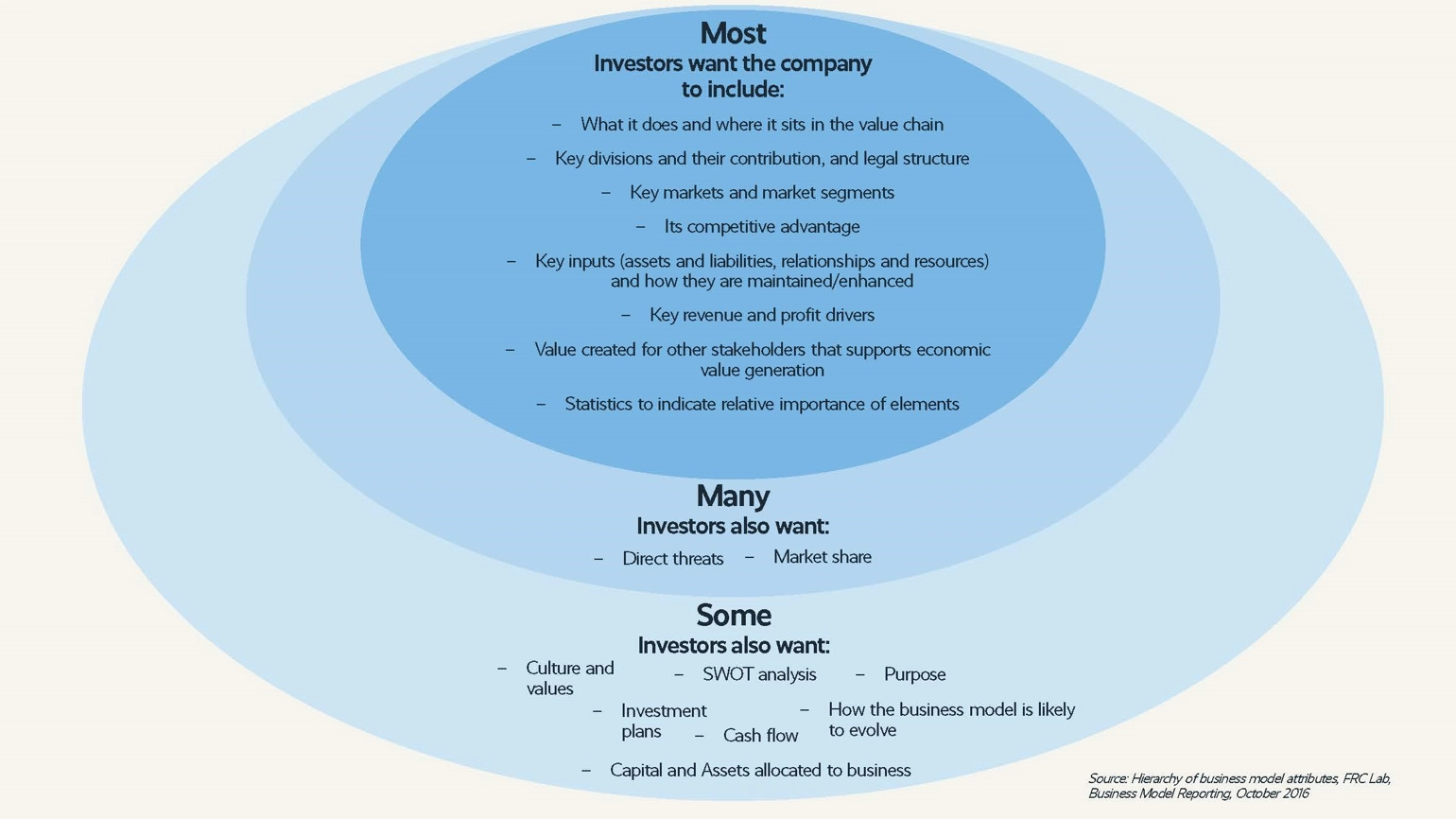

When it comes to deciding on content to feature in your business model section, a survey of investors by the Financial Reporting Council (FRC) is a useful starting point. It was carried out in 2016 but has held up well.

While investors were interested in direct threats and market share information, we think this can be covered elsewhere in a market overview. Several areas highlighted by a smaller proportion on investors have become more central to reporting, however. While it’s not necessary to repeat the corporate purpose in this section, it should be very clear that the business model is rooted in the purpose, which also has clear links with culture and values. More recent research has shown that investors are keen to understand capital allocation, which can be covered in the business model (see IHG below) or the strategy section.

Clarity and insight

Setting out what a business does sounds simple but reporters, who know their business better than any reader, should appreciate the amount of detail and clarity required for those on the outside. A graphic will help provide clarity, but reporters shouldn’t be afraid of providing copy for a fuller explanation.

The University of Zurich talks about describing core competencies plausibly. Try not to state the obvious or provide descriptions that are so basic, they do nothing to provide a credible insight into the business.

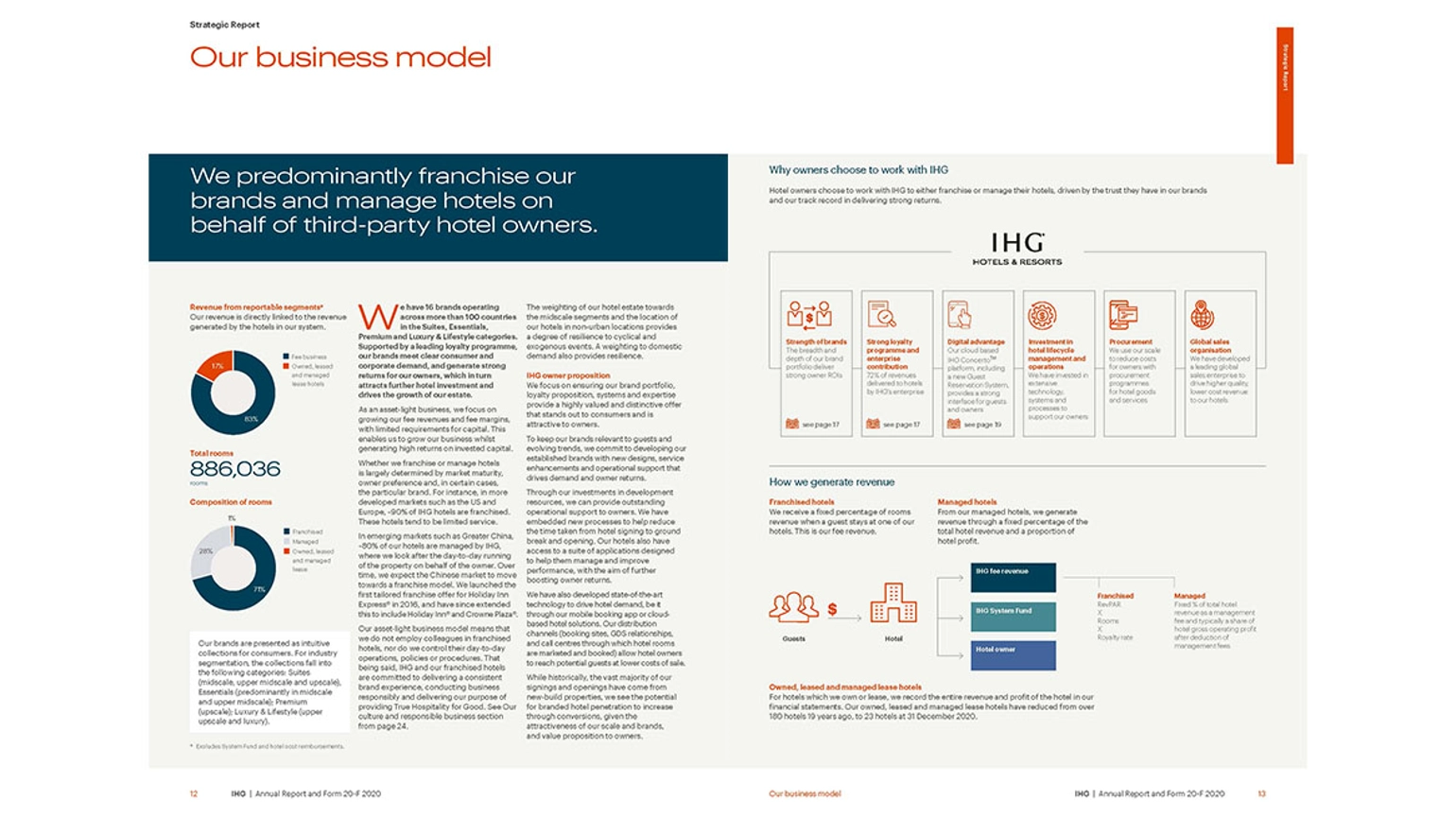

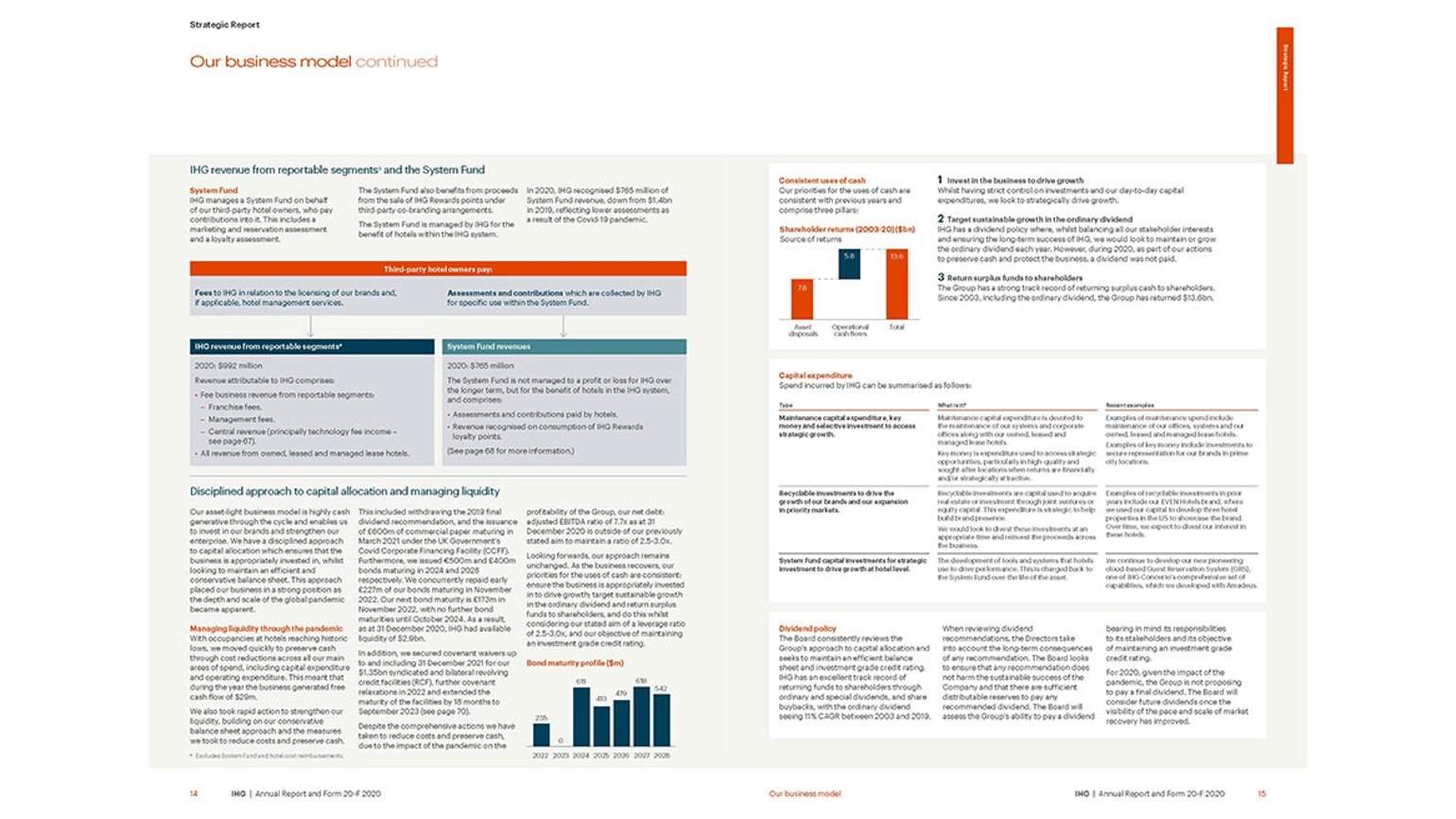

IHG

The first page of IHG’s business model provides a useful overview and the second page highlights its benefits and revenue model.

The third page includes details on capital allocation and liquidity during the Covid-19 lockdown before the fourth page finishes on capital expenditure and the dividend policy.

Click here to download the IHG PDF.

Working in harmony with other sections of the annual report

In line with the FRC’s guidance for the strategic report, the business model should focus on the elements of a value chain that are most important to an understanding of the generation and preservation of value. What the business does and where it sits in the value chain should be clear to readers.

In light of forthcoming initiatives in ESG reporting, we would also add that the business’ influence over upstream and downstream elements of the value chain should be made clear. Businesses need to explain how they are working along the value chain - from suppliers to end users - to address social and environmental factors including carbon emissions. A graphic that shows the full picture can be linked to detailed information further back in the report.

A good business overview will cover key divisions and the legal structure with a market overview outlining key markets and segments. Disclosures within the business model don’t need to repeat this. A brief description that conveys how the business is structured and how it engages with its markets will suffice. Similarly, it’s helpful to show the key resources and relationships that underpin the long-term success of the business model, but information on how these are being maintained and developed are best done in a separate section of the report with clear linkage back to the business model.

Important content that is often missing

An important part of the business model, and one that is too often overlooked, is a description of how the business makes money. Providing information on profit and revenue drivers, which could include an overview of macroeconomic influences, should be central to a business model description. Reporters should explain their organisation’s competitive advantage and the economic principles that underpin its business model. Does the business enjoy scale economies or demand-side economies in the form of network effects, for example.

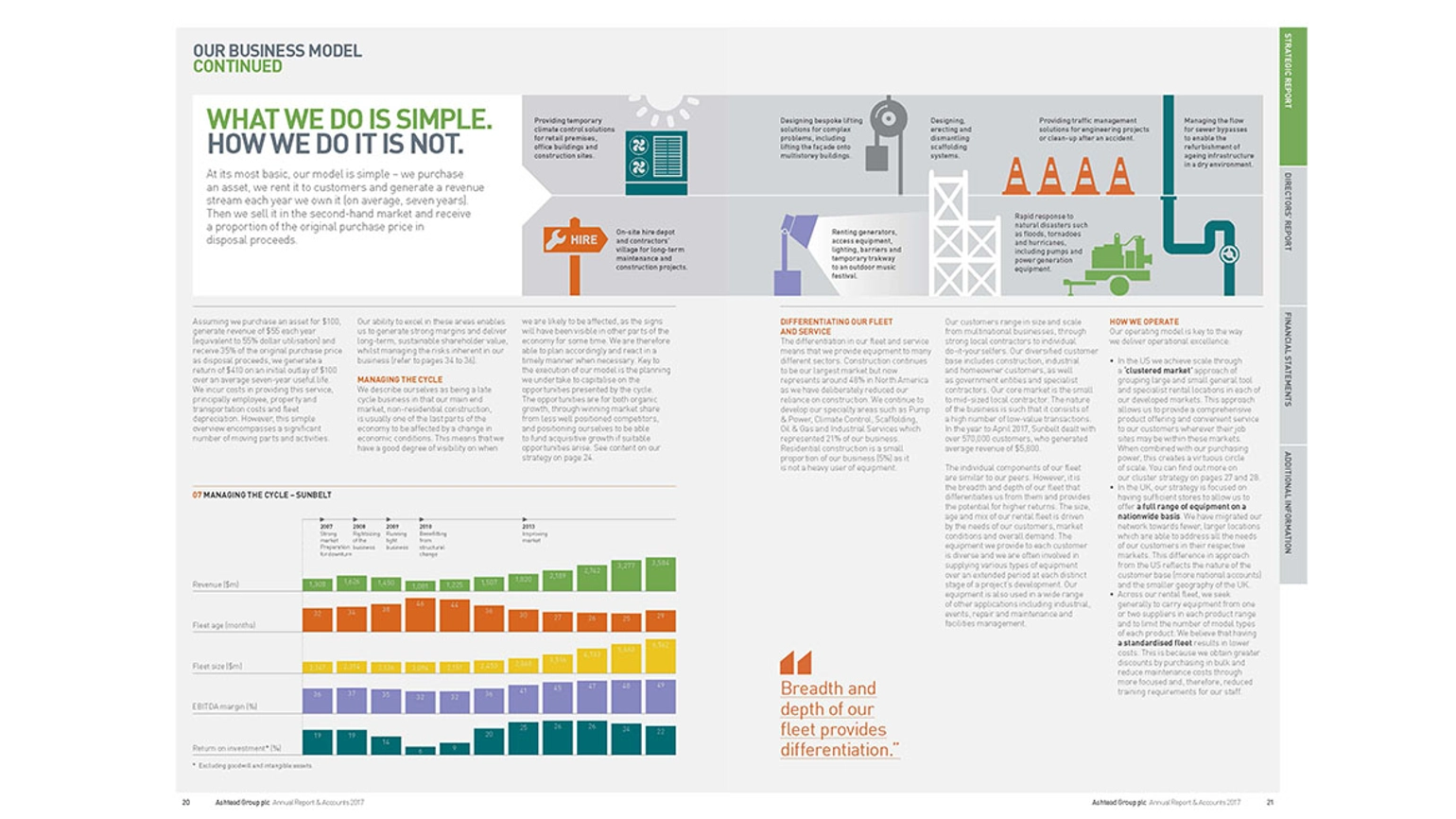

Ashtead

Ashtead is good at describing how it makes money in the first paragraph on page 20. It draws on economic principles to explain the business model, which is does very well by explaining the business cycle and scale economies.

It’s also strong on showing how the business is structured and organised to differentiate itself and achieve cost benefits.

Click here to download the Ashtead PDF.

Where the business model ends and the strategy begins

Don’t be tempted to include your strategy. The business model is descriptive and won’t change much from year to year. Your business model describes how the business creates value; your strategy describes a plan to maximise value creation over a medium-term period or strategy cycle.

Framing and linkage

Because it’s a description of the business, you can use the business model to frame the

content within your annual report. For the same reason, there will be opportunities for linkage and cross-referencing other disclosures within the report such as risks or KPIs. This can help you decide if the annual report includes key elements and will contribute to a robust report.

GPE

These are the third and fourth pages in a four-page business model and use a value chain to explain each stage of developing a property. The description shows how the business makes money and some granular risk descriptions enable the reporter to align operational risks with each stage of its process.

Click here to download the GPE PDF.

Sector considerations

Guidance on business models usually refers to a value chain but this isn’t aways the most appropriate way of describing a business, especially one that is asset-light and doesn’t produce anything tangible. These reporters, for example technology and financial services companies, often struggle to describe what they do and, when searching for a suitable noun, rely heavily on ‘solutions’. In these cases, reporters need to find another way of describing what they do. This can be done by explaining the core benefit of their services or the problem they solve.

Visualising and describing business models for financial services companies is tricky because of the intangible nature of the business. In this case we recommend starting with the financial flows to link together value-creating activities.

Zurich Insurance Group

In this business model, the financial flows are used to link value-creating activities and supporting copy provides a concise explanation.

Click here to download the Zurich Insurance Group PDF.

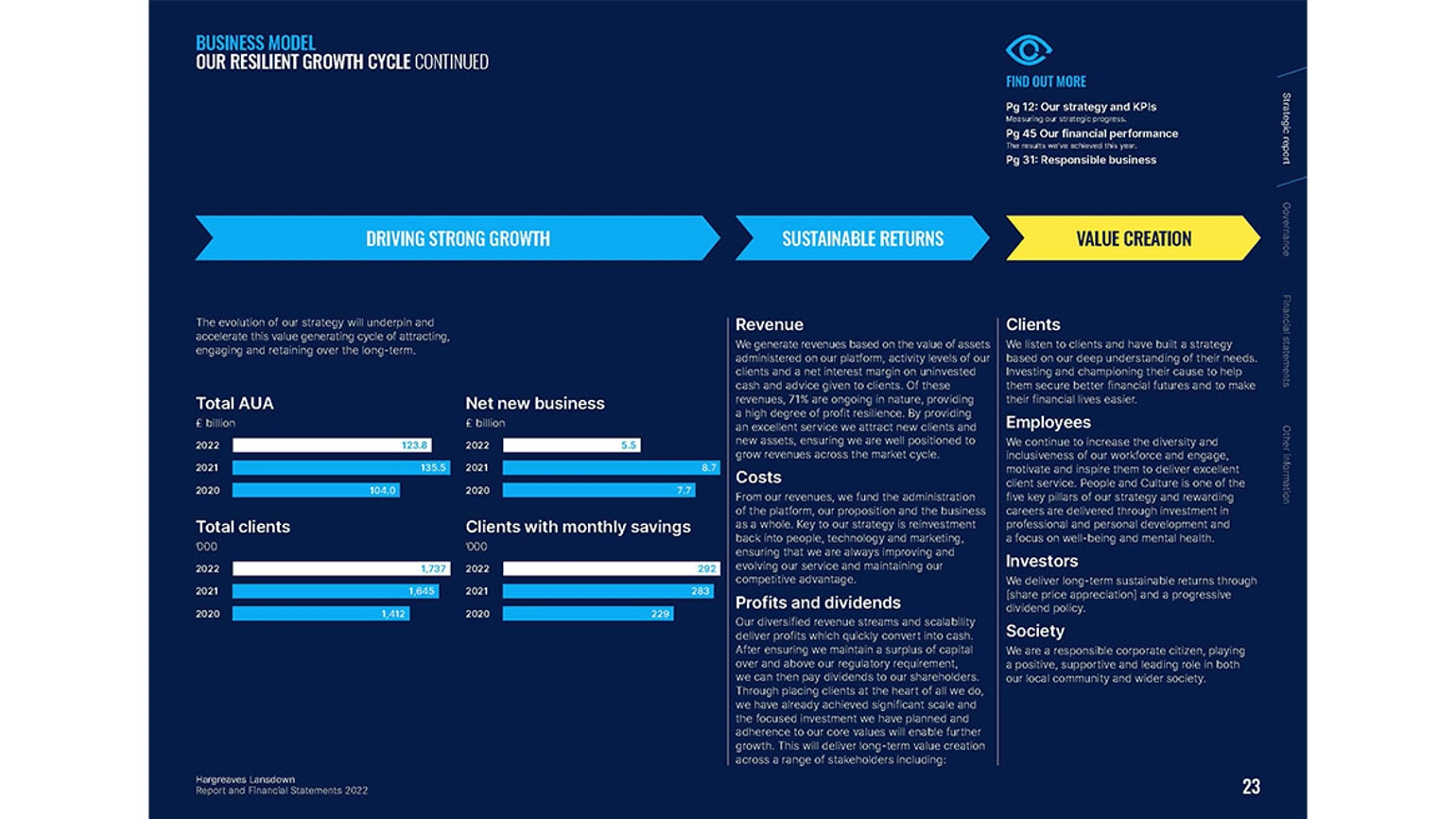

Hargreaves Lansdown

Another approach seen in the financial services sector, but not exclusively, is the use of flywheels to describe a series of self-reinforcing, value-creating activities.

On the following page, the growth cycle explains how the investment service provider seeks to grow business and the revenue and cost disclosure provide an insight into its economics with figures on recurring revenues and operating costs illustrating the financial characteristics of the business model.

Click here to download the Hargreaves Lansdown PDF.

The FRC is currently looking at how business model reporting has evolved – we look forward to reading the findings. But there’s no reason to wait until they’re released after the start of the next reporting cycle: reporters applying the advice in this article will bring more innovation to their business model reporting, raise standards, and provide information that plays a fundamental role in helping investors understand their business.